On April 20, 2010, the greatest environmental disaster in U.S. history began. At 9:56 PM, a fire began on an oil rig called the Deepwater Horizon. Within five minutes, the rig exploded, and burned for over a day before sinking into the Gulf of Mexico.

The day the rig sank (April 22), the Coast Guard reported that oil was leaking from the rig at a rate of about 8,000 barrels (340,000 gallons) per day- a very optimistic estimate. The leak flowed for 87 days, and the official US Government estimate of the total spilled was 4.9 million barrels (210 million gallons) – or seven times the Coast Guard’s estimate per day.

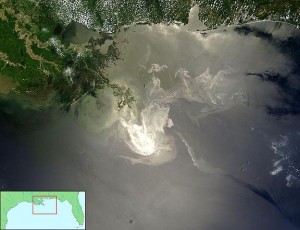

Deepwater Horizon oil spill from space – May 24, 2010. Photo by NASA/GSFC, MODIS Rapid Response AND demis.nl AND FT2 (public domain) via Wikimedia Commons

On Tuesday, it was announced that Halliburton, the company who poured the cement for the well, had reached a $1.1 billion settlement with thousands of businesses, individuals and local governments that suffered losses from the explosion and subsequent spill.

The settlement includes punitive claims of property damage and damage to the commercial fishing industry, as well as claims assigned against Halliburton by BP in BP’s 2012 class action settlement. It also includes legal fees. The settlement still has to be approved by the District Court for the Eastern District of Louisiana. In announcing the settlement, Halliburton’s attorneys stated that the agreement resolves “a substantial majority” of its liability in the disaster.

Stephen Herman and James Roy, the leaders of the steering committee for the plaintiffs, said in a statement that “Halliburton stepped up to the plate and agreed to provide a fair measure of compensation to people and businesses harmed in the wake of the Deepwater Horizon tragedy.”

The settlement has been expected ever since Halliburton pleaded guilty last July to destroying evidence after the spill. The penalties for that ruling were minor- a $200,000 fine (the maximum allowable, believe it or not) and three years probation (how do you put a company on probation anyways?). However, it also gave credence to the fact that Halliburton was liable. With that in mind, Halliburton said in a statement on Tuesday that, “An agreement denies liability; it is not an admission of liability.”

BP’s response to the settlement is just about what you’d expect. In an e-mailed statement, BP senior vice president Geoff Morrell said: “This settlement marks the very first time — despite three years of official investigations and litigation implicating the company — that Halliburton has acknowledged that it played a role in the accident. The evidentiary record demonstrates that Halliburton recommended and pumped an unstable cement slurry; intentionally destroyed and failed to produce uniquely relevant evidence showing the slurry to be unstable; and failed to properly monitor the well and detect the influx of hydrocarbons.”

By resolving most of both punitive and compensatory liability in most lawsuits from private plaintiffs and local governments, the settlement will let Halliburton avoid billions in punitive and compensatory damages if they’re found to have committed fraud and gross negligence in a ruling due shortly dealing with how much blame each company carries for the disaster.

We’ll be writing more about Halliburton in the next couple weeks; their story over the last twenty years is rife with being exempted from laws, dodging responsibility and the like. We’ll look at how a former Secretary of Defense with zero experience in the oil business became the CEO of Halliburton, and how this led to numerous government contracts and exemptions from laws they found onerous. Then, we’ll look at what happened with Halliburton when this CEO resigned and became Vice President of the United States instead. It sounds like fiction, doesn’t it? We wish it were…