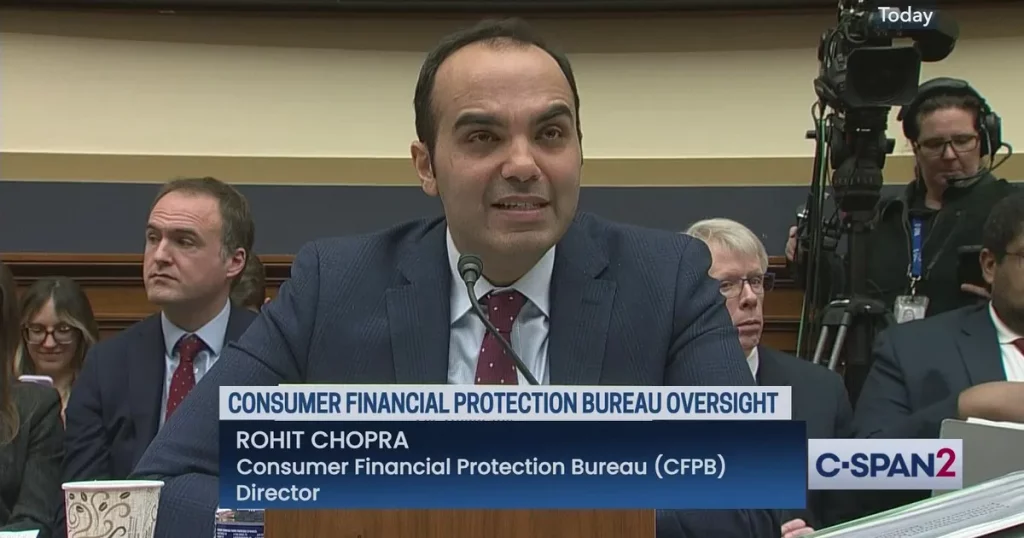

“The CFPB is proposing clear, enforceable rules that will reduce overdraft fees and save Americans billions, closing another lucrative regulatory loophole banks use to prey on consumers,” said one advocate.

By Brett Wilkins. Published 1-17-2024 by Common Dreams

In a move cheered by progressive advocates, the U.S. Consumer Financial Protection Bureau on Wednesday proposed a new rule limiting how the nation’s biggest banks can charge overdraft fees.

The CFPB said its proposal “would close an outdated loophole that exempts overdraft lending services from long-standing provisions of the Truth in Lending Act and other consumer financial protection laws.”

Continue reading