“CFPB is continuing a deregulatory, anti-transparency, anti-accountability, anti-consumer protection rulemaking agenda, even in the face of Covid-19.”

By Jake Johnson, staff writer for Common Dreams. Published 4-17-2020

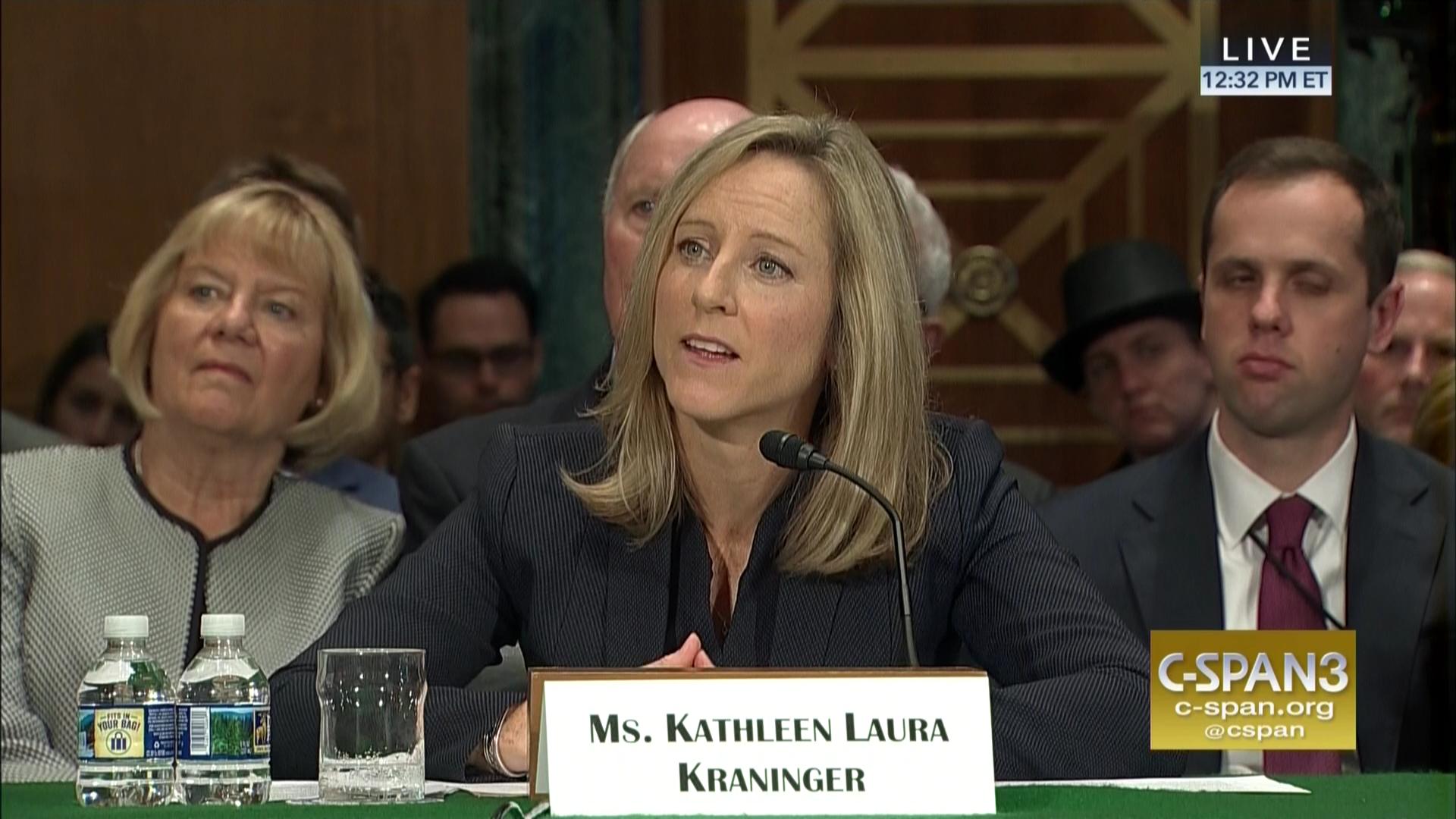

Consumer Financial Protection Bureau director Kathy Kraninger testifies during a confirmation hearing before the Senate Committee on Banking, Housing, and Urban Affairs. Photo: C-SPAN screenshot

Amid an unprecedented economic crisis driven by the novel coronavirus pandemic, the Consumer Financial Protection Bureau is reportedly pushing ahead with a series of rule changes that watchdog groups say would reward predatory lenders and leave vulnerable people more susceptible to industry abuses at the worst possible time.

The American Banker reported this week that the CFPB—headed by Kathy Kraninger, an appointee of President Donald Trump—is “moving forward with its payday lending and ‘qualified mortgage’ rules despite logistical issues and the industry’s focus on economic effects from the coronavirus pandemic.” Continue reading