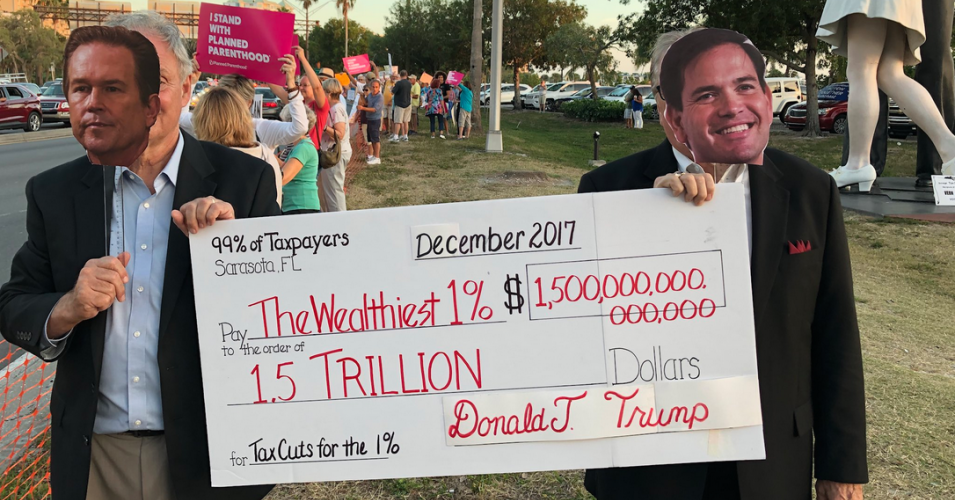

“As someone who has enjoyed the benefits of wealth my whole life I know how skewed our economy is and I cannot continue to sit back and wait for someone, somewhere, to do something,” said one demonstrator.

By Brett Wilkins Published 5-22-2022 by Common Dreams

Activists Marlene Engelhorn and Phil White demand that the rich get taxed at a May 22, 2022 protest outside the World Economic Forum conference in Davos, Switzerland. (Photo: Patriotic Millionaires U.K./Twitter)

As some of the world’s wealthiest and most powerful people—sans the usual Russian oligarchs—descend upon the swank Swiss ski resort of Davos for the start of the World Economic Forum’s annual meeting on Sunday, a multinational coalition of millionaires of conscience took direct action to demand that governments #TaxTheRich.

Activists from Patriotic Millionaires, Patriotic Millionaires U.K., taxmenow, and the 99% Initiative, who protested outside the elite compound, had a message for conference delegates: “Extreme wealth is eroding democracy,” and taxing the rich will “reduce inequality and help deal with the cost of living scandal playing out in multiple nations around the world.” Continue reading