“Should Justice Alito preside over this case despite his clear conflicts of interest, it would add to the worsening Supreme Court corruption crisis and underscore the urgent need for ethics reform,” said one critic.

By Julia Conley. Published 9-18-2023 by Common Dreams

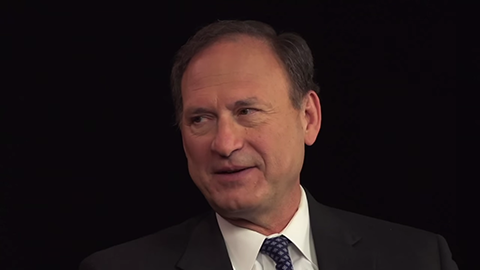

Anti-corruption watchdog Accountable.US on Monday said there is a clear need for U.S. Supreme Court Justice Samuel Alito to recuse himself from an upcoming court case regarding the Consumer Financial Protection Bureau, as a new analysis revealed the extent of one of his key associate’s financial interests in the case.

The group released new data showing that hedge fund manager Paul Singer holds at least $90 million in financial firms overseen by the CFPB, which was established in 2011 through the Dodd-Frank Wall Street Reform and Consumer Protection Act and has since provided $16 billion in financial relief to defrauded consumers and ordered companies to pay $3.7 billion in penalties.

The findings were released three months after ProPublica revealed Singer paid for a luxury fishing trip for the right-wing justice in 2008, costing him an estimated $100,000 each way. Alito has never recused himself from subsequent cases in which Elliott Management, Singer’s firm, was directly involved, including one in which the court awarded $2.4 billion to the fund.

Now, said Accountable.US, “should Alito choose to preside over this case despite his billionaire benefactor’s direct financial stake in the outcome, it would only fuel an already raging Supreme Court corruption crisis,” referring to numerous reports of Justices Alito, Clarence Thomas, Neil Gorsuch, and others accepting gifts or money from groups or people with business before the court.

BREAKING: Justice Alito enjoyed untold amounts of luxury and largesse from a billionaire hedge fund manager who would likely be personally enriched if #SCOTUS rules against the @CFPB in an upcoming case. https://t.co/mt40egefdG

— Accountable.US (@accountable_us) September 18, 2023

The case, which the court is set to hear on October 3, is CFPB v. the Community Financial Services Association of America (CFSA) and pertains to the CFPB’s funding structure. Opponents—including Republican lawmakers whose own constituents have directly benefited from the agency’s work—claim it is unconstitutional for the agency to be funded through the Federal Reserve and say Congress should approve appropriations for the CFPB regularly.

“In one fell swoop,” said Accountable.US on Monday, “an anti-CFPB-led Congress could cut the purse strings and erase over a decade of consumer protections and rules that have made our markets fairer and more stable.”

The watchdog said the lawsuit filed by a group that represents payday lenders “has nothing to do with upholding the Constitution and everything to do with obstructing the agency that holds the financial industry accountable when they harm consumers.”

The group highlighted Singer’s connections to the case, including:

- Elliott Investment Management’s holdings of $60 million in Fidelity National Information Services, which has over 5,000 complaints in the CFPB’s database and has said the agency could have “an adverse impact” on its business;

- The fund’s holdings of more than $30 million in Q2 Holdings, Inc., which issued a statement on the case backing the CFSA;

- The fund’s 2017 letter to investors calling on the Trump administration to undo the CFPB’s independent funding structure and saying “the financial system needs to be freed from the dysfunctional dictates” of Dodd-Frank financial reforms; and

- Singer’s own statement in 2011 in which he said Dodd-Frank was “entirely nutty.”

“The sprawling web of financial dealings Mr. Singer has overseen by the CFPB explains why his firm has aggressively criticized the agency’s independence,” said Liz Zelnick, director of Accountable.US’ Economic Security and Corporate Power program. “The cause for Alito’s recusal in this matter is cut and dry. Should Justice Alito preside over this case despite his clear conflicts of interest, it would add to the worsening Supreme Court corruption crisis and underscore the urgent need for ethics reform.”

The watchdog’s report shows that Alito “enjoyed untold amounts of luxury and largesse from a billionaire hedge fund manager whose business interests would benefit if the Supreme Court allows for the worst rollback of consumer protections in U.S. history,” Zelnick added.

Accountable.US warned that Alito’s failure to recuse himself from the case could make it more likely that the court will side with “predatory lenders” like those tied to Singer’s business.

“That will likely mean the agency’s future funding will be beholden to the political whims of Congress,” said the group. “There is little doubt a U.S. House of Representatives made up of lawmakers openly hostile to the CFPB—like the current MAGA Majority—would zero-fund the agency the first chance they get on behalf of their financial industry donors.”

“It would be catastrophic,” the watchdog added, “for consumers, honest businesses that simply want to compete fairly, and the stability of financial markets.”

This work is licensed under Creative Commons (CC BY-NC-ND 3.0).