Yesterday, thousands of Venezuelans took to the streets to protest against President Nicolas Maduro’s government and the deepening economic crisis in the country. We’ve written about the protests last spring and the Maduro government’s response; since then, the situation’s only become worse.

Photo: @Claritta61

Last year’s protests centered around the chronic shortages of basic goods, inflation and corruption in the government. This year, the same things are driving the protests, but the situation’s even more desperate. To understand why, we need to go back to the beginning of the last decade.

At the end of 2002 and into 2003, PDVSA, the state-owned natural gas and oil company, participated in a national strike and locked out workers in an attempt to force Hugo Chávez, Venezuela’s president at the time, to call for early elections. Production was virtually stopped for two months. When the strike ended, 19,000 people working for PDVSA lost their jobs and were replaced by people loyal to the Chávez regime, but by then the damage had been done. Unemployment had risen to over 20%, and the country’s GDP fell 27% in the first four months of 2003.

Later that year, Chávez instituted currency controls, setting an official exchange rate. This practice is still in place today. However, the official exchange rate is only available if you are a friend of the government’s, and led to a parallel black market where the exchange rate was many times higher than the official rate. Needless to say, this provides many opportunities for corruption.

Writing for Foreign Policy, Juan Cristóbal Nagel explained it like this:

“Venezuela’s exchange rate system resembles something out of a dystopian Terry Gilliam movie. The government controls the sale and purchase of all foreign currency in the country. The price it sets varies according to the needs of the buyer. In practice, this usually depends on whom the person in question knows inside the government.

In theory, “basic” imports such as food and medicine can be financed with dollars purchased using the 6.3 rate, which has been in place for several years. Dollars for travelers and other imports are sold at higher rates, depending on what the purchaser wants them for…

Few importers, even those bringing food and medicine into the country, can actually get access to the 6.3 rate. The worst-kept secret in Caracas is that this gimme is available only to high-ranking military officers and businesses connected to the Revolution.

The way this distortion feeds scarcity can be illustrated with the following example. Someone — a socialist businessman, say, or a general — files the paperwork saying they need dollars to import $100,000 worth of diapers. They pay 630,000 bolivars. They then import, say, $5,000 worth of diapers, and the rest they sell in the black market, where $95,000 fetch 17,100,000 bolivars.”

So, not only do you have obscene profits made by currency manipulation, you also have very real shortages in basic goods for the citizens, which in turn leads to inflation. And, then there’s the collapse of the oil market in recent months.

Oil is Venezuela’s most valuable resource. The largest known oil reserves in the world belong to Venezuela, and oil makes up 95% of the country’s exports. All the social programs carried over from the Chávez years are paid for by oil profits, usually in the form of petrodollars from China. But, here again there’s graft and corruption, and a good portion gets skimmed from the profits. With oil going for under half of what it did six months ago, the problem seems obvious – Venezuela’s running out of money.

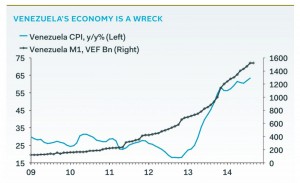

On Wednesday, Maduro gave his yearly address to the National Assembly. In the address, he blamed “criminal gangs,” “economic sabotage” and private business interests for Venezuela’s economic woes. He also announced a 15% raise in the minimum wage, as well as increased housing and education. While this sounds good, it’s mostly smoke and mirrors, as the inflation rate last year was over 60%. And, the chronic shortages of imported goods (which are anything either imported or made with imported materials or parts) have only become worse.

Back in November, we said that the sharp drop in oil prices could lead to instability in some of the countries that depend on increasing oil revenues to balance their budgets. We’re sorry to be proven right so soon. Is it any wonder that the people are unhappy?