By Gretschman for Occupy World Writes

![[Public domain], via Wikimedia Commons](http://occupyworldwrites.org/wp-content/uploads/2014/02/1920_tax_forms_IRS-300x226.jpg)

[Public domain], via Wikimedia Commons

There are at least 1,910 forms and supporting documents on the Internal Revenue Service (IRS) website. The tax form that most Americans fill out for the purpose of federal tax liability has a 206 page set of instructions that go with it. American citizens are taxed at varying rates: up to 39.6 percent of their income.

The IRS calculates a burden of 7 hours and $120 for the average taxpayer to complete a federal tax return (Form 1040). For businesses, the IRS calculates a burden of 24 hours and $430.

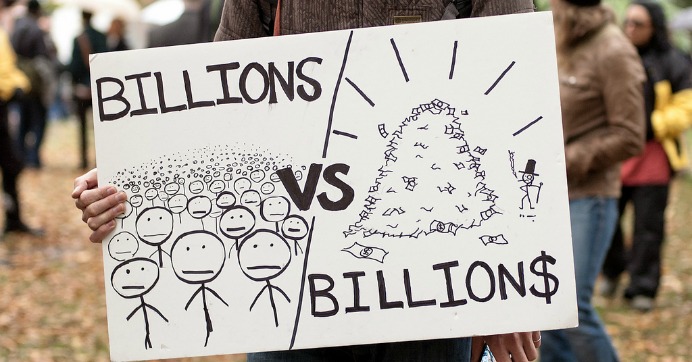

Can’t we simplify this ? What if the existing tax code with its page after page of additions and exclusions was thrown out so that all citizens and businesses would pay the same flat rate on their income? No more having multi-billion dollar corporations paying less taxes than the average citizen pays.

Instead of pages and pages of tax code that favor those who helped write the tax code, one flat tax rate would apply to all. If all income was subject to a 7 percent tax paid to the federal government and a 3 percent tax was paid to the state or local municipality where the citizen or business resided the federal, state and local governments would have enough money to provide the types of programs and services that are now at the mercy of political wrangling. Most, if not all, citizens would be overjoyed to bring home 90 percent of their gross wages.

How much money and time would be saved by having a simplified tax code? How much less would the government spend on implementation and enforcement of a simpler tax code? How much more money would the average citizen have to spend on education, entertainment, or just the basic necessities of daily living?

If the only things that are certain in this life are death and taxes, can’t we at least try to make the second one feel a little less like the first?

![[Public domain], via Wikimedia Commons](http://occupyworldwrites.org/wp-content/uploads/2014/02/1920_tax_forms_IRS-300x226.jpg)