Do you remember voting for lobbyists to decide who pays what in taxes? We don’t.

On Friday night, the Senate passed their version of the #GOPTaxScam. The bill, all 479 pages of it, was presented to the full Senate just hours before the vote. The vote was along party lines, with the one dissenting vote among the Republicans coming from Senator Bob Corker of Tennessee.

So, what was in this bill, and why did they vote on it before all the Senators could actually read through the bill? We’re glad you asked. First, what’s in it.

A lot of the bill is what you’d expect. For example:

- The top individual rate is reduced from 39.6% to 38.5%, and the threshold at which the top rate kicks in is increased from $418,000 for a single/$480,000 for married filing jointly to $500,000/$1,000,000

- The estate tax exemption is doubled, to $11 million for a single taxpayer and $22 million for married taxpayers.

- The corporate rate is reduced from 35% to 20%.

- The top rate on the income earned by owners of “flow through” businesses — S corporations and partnerships — is reduced from 39.6% to a shade below 30%.

Questions about these measure that we were forced to ask include; how is it that corporations are able to keep the tax deductions that have now been excluded from individual tax bases? Why is the corporate tax is now LOWER than the top individual rate? If corporations are people too, why is there ANY difference in these tax rates?

Then, there’s the “Why are these items in a tax bill, anyways?” parts. These include:

- A provision that explicitly allows parents to use tax-free college savings plans, known as 529s, for a “child in utero.” This is essentially a personhood bill, setting a precedent for the legal definition of life beginning at conception.

- The bill repeals the Johnson Amendment, which bans non-profit groups from engaging in political activism. This would mean that churches and the like could actively engage in elections without disclosing individual donors; think of it as Citizens United on steroids. This serves the purpose of blurring the lines between the separation of church and state, allowing the churches to donate and promote individual candidates in local and national elections, all while cloaked under the donation secrecy this provision allows.

- Eliminating the individual mandate of the ACA. While this actually does deal with taxes (the fine for not being insured is paid as part of your taxes), removing the mandate means that younger and healthier people won’t buy insurance until they need it. These are the people who currently offset the cost of providing healthcare to the older and sicker people. Without this in place, premiums will rise dramatically more than the anticipated 10% over the next 10 years.

- A provision that would open part of Alaska’s Arctic National Wildlife Refuge, or ANWR, to oil and gas exploration. While this would raise revenue, it only amounts to $2 billion over the next ten years, at the cost of almost assuredly ruining the local environment and ecosystem. Additionally, it is worded in such a way that it is actually ILLEGAL to not drill, forcing Alaska to accept ANY drilling permits and fields desired.

Of course, the individual tax cuts are set to expire, meaning that the middle class will see a tax increase. And, what’s going to pay for these? The GOP mantra’s always been that tax cuts pay for themselves, but others, such as Marco Rubio, have already admitted that the tax reform is part one of a two-step process designed to defund and eventually dismantle Medicaid, Medicare and Social Security; the very programs designed to help the elderly, disabled and poorest members of American society.

Now obviously, a lot of these proposals don’t sit well with the electorate. So, why the rush to pass it? The GOP needs a victory. Even with controlling both houses of Congress and the White House, this administration’s been notably inept in getting meaningful things accomplished. Furthermore, the GOP donor class has stated that the campaign money will dry up if they don’t get the tax cuts they want.

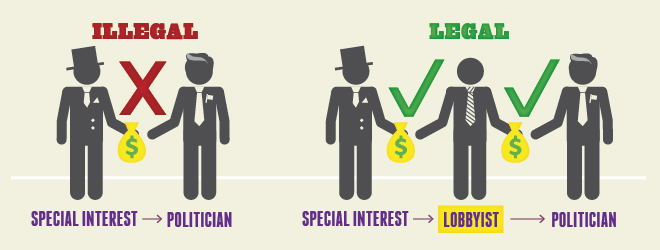

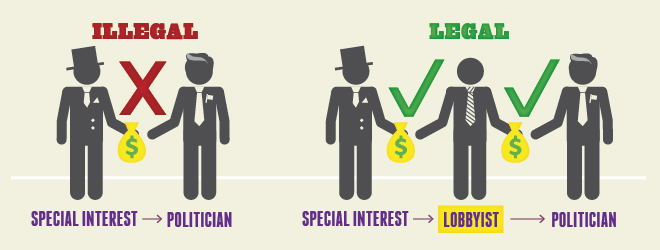

Photo: Represent.US

So, who came up with most of the amendments? Lobbyists. Out of the 11,000 registered lobbyists in Washington, more than 6,000 said that they worked on taxes this year. That works out to 11 lobbyists for each member of Congress. Do you remember electing lobbyists to write our laws? We sure don’t.

We still have a chance to stop this. The House and Senate bills now go to a conference committee. The bill that comes out of that will need to be passed by both houses. The healthcare fiasco this summer proves that if we’re loud and persistent enough, our message gets through. And, with the bill only having 37% approval before the vote, there’s enough of us to make the message get through.

And what if it doesn’t? The last time that the GOP had won control of both houses and the presidency before 2016 was 1928. The new tax bill looks even more extreme than the policies put into place by the Republicans after the 1928 election. Does anybody remember what happened in 1929?

Another annoying historical factoid that you may wish to remember at a time like this: 244 years ago, a group of people decided that they weren’t going to pay taxes without proper representation, and what became known as the Boston Tea Party took place. This in turn led to a revolution, and the founding of this country.

“Those who cannot remember the past are condemned to repeat it.” – George Santayana