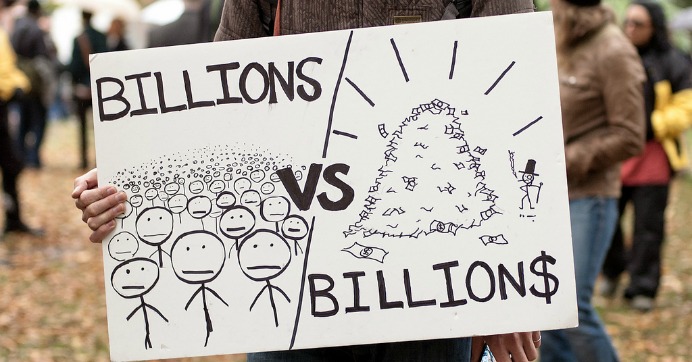

‘The idea that this plan would help average Americans instead of the wealthy and big corporations has been a hoax all along.’

Mick Mulvaney press conference about President Donald Trump’s budget plan. Screenshot: YouTube

By Jon Queally, staff writer for Common Dreams. Published 9-26-2017

Trumpcare may be dead again (for a while at least) on Tuesday, but Republicans now want to get serious about what they call “tax reform,” but which critics are resolute in saying is just a major push to give the nation’s corporation and wealthiest individuals another massive giveaway they don’t need and certainly don’t deserve.

A day ahead of the Trump administration’s scheduled release of what it says will be a “detailed” tax plan, progressive policy groups are again warning the American people not to be fooled by rhetoric as they highlight estimates showing the likely proposal will cost the government trillions of dollars in revenue over the next decade and lead the way towards massive cuts in key social programs that help insulate low-income and working Americans from an economy already “rigged” in favor of the wealthy and powerful. Continue reading