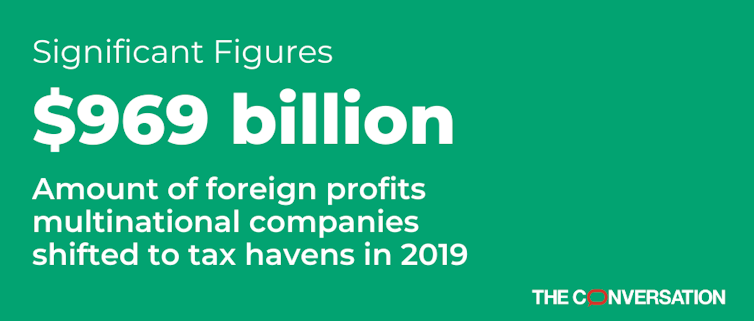

“Both kinds of corporate misbehavior—underpaying taxes and overpaying executives—ultimately make working families the victim through smaller paychecks and diminished public services.”

By Jake Johnson. Published 3-13-2024 by Common Dreams

Top executives at dozens of major, profitable U.S. businesses received more in total compensation in recent years than their companies paid in federal taxes, underscoring the twin outrages of skyrocketing CEO pay and rampant corporate tax dodging.

A report published Wednesday by Americans for Tax Fairness (ATF) and the Institute for Policy Studies (IPS) identifies 35 profitable U.S. corporations that paid their top executives more than they paid the federal government in taxes between 2018 and 2022. The list of companies includes Ford, Netflix, NextEra Energy, and Tesla—whose CEO, Elon Musk, is the richest man in the world.

Continue reading